modified business tax rate nevada

Sales Tax Sourcing becomes much more important for retailers who ship products to other locations such as online retailers and those who sell products by catalog. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable.

Grant Sawyer Office Building.

. If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state. In this case the sales tax is based on the rate where the store is located. January 1 2000 Enclosed are the 2000 BPOL Guidelines for the Business Professional and Occupational License BPOL Tax.

For more information contact. Nevada Secretary of State -Las Vegas Office. Our partner TaxJar can manage your sales tax calculations returns and filing for you so you dont need to worry about mistakes or deadlines.

You may apply online or obtain the forms from their website wwwnvsosgov. In the 2011 Legislative Session reduced the interest rate to 075 or 0075 from 1 or 01 effective 712011. The license is renewable annually.

However if the gross revenue of your corporation exceeds 4000000 during the taxable year in the future you will be required to file a Commerce tax return for your business for that taxable year. My Nevada business closed during the year. Automate your businesss sales taxes.

When you ship a product to another address the knowledge of your tax rules becomes very important in. All businesses operating in Nevada must obtain a State Business License issued by the Nevada Secretary of State. Do I have to file the Commerce Tax return.

Legislation enacted by the General Assembly in 1996 directed that the BPOL Guidelines be updated triennially to provide a current interpretation of Code of Virginia 581-3700 et seqThis edition incorporates the statutory and. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375.

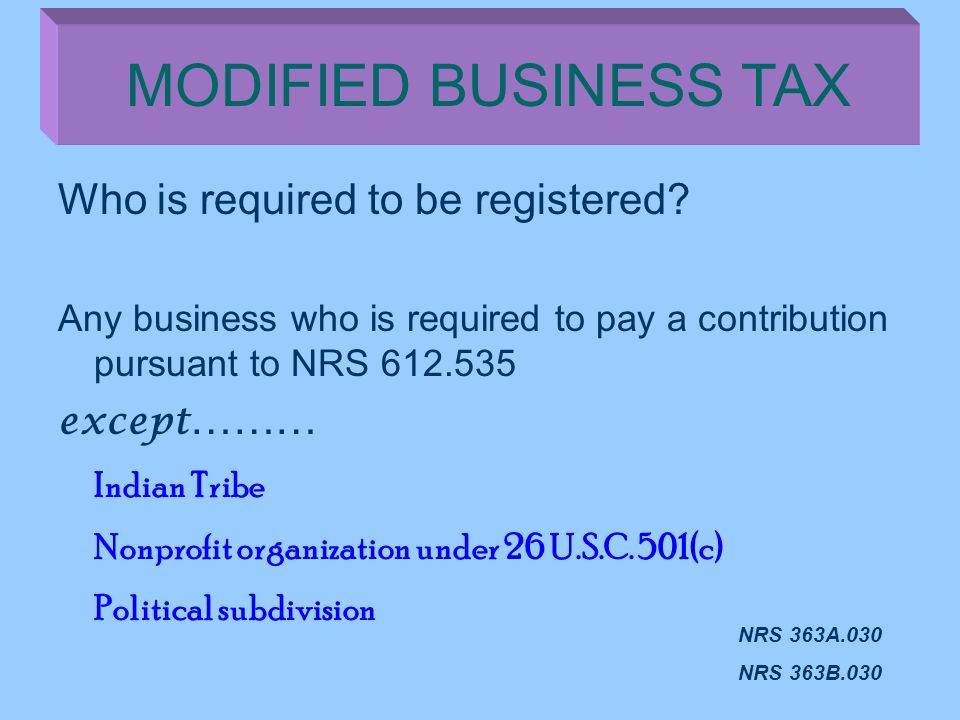

State Of Nevada Department Of Taxation Ppt Video Online Download

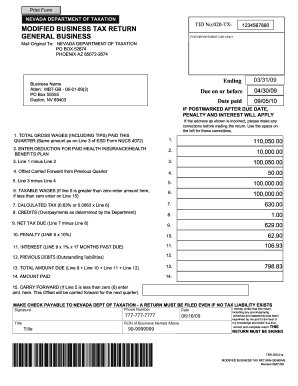

2014 2022 Form Mt Ui 5 Fill Online Printable Fillable Blank Pdffiller

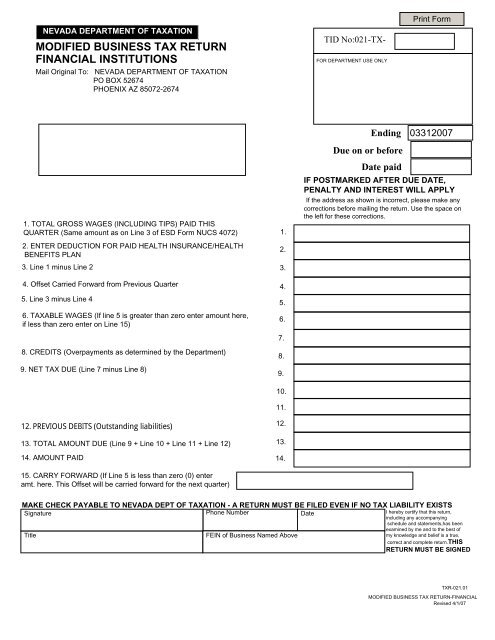

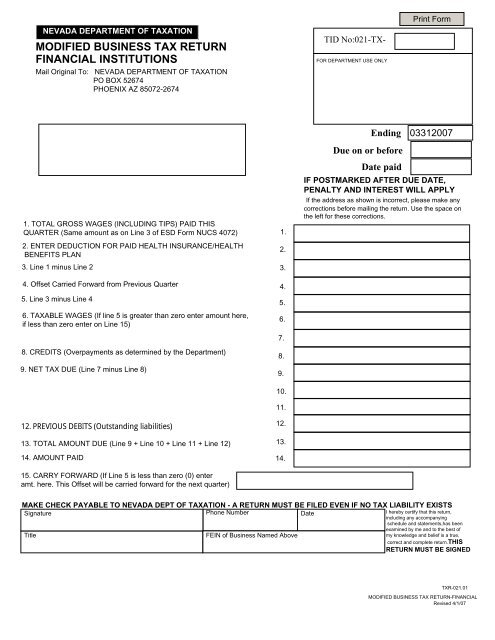

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Does Qb Offer The Nv Modified Business Tax Payroll Form

State Of Nevada Department Of Taxation Ppt Video Online Download

What Is The Business Tax Rate In Nevada

The Nevada Income Tax Rate Is 0 This Does Not Mean You Will Not Be Taxed On Your Earnings

State Of Nevada Department Of Taxation Ppt Video Online Download